When you file an extension, your tax return process might be a bit more complicated than most. 15 in order to make the tax filing extension deadline.

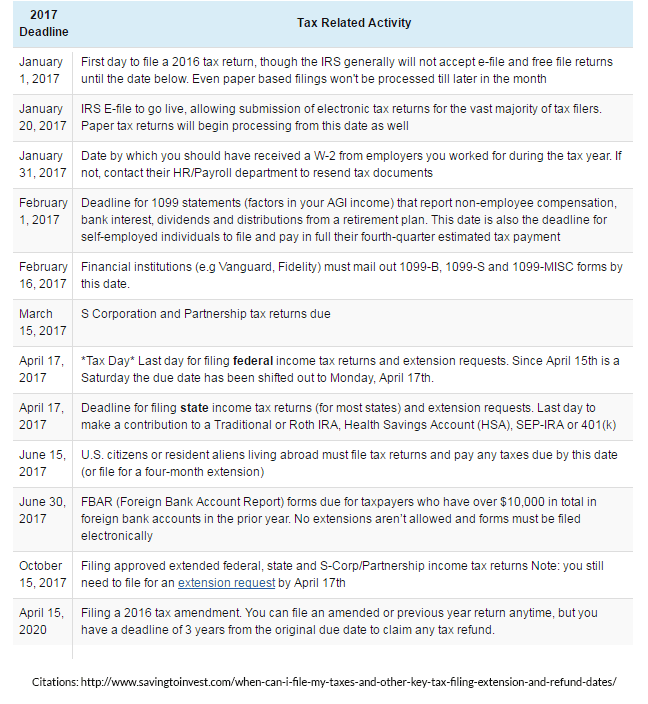

The mailbox rule requires that your return is postmarked and sent by Oct. The IRS actually has a payment plan program that's surprisingly easy to enroll in, as well as several other options if you can't pay. The tax filing deadline for the 2021 tax season is the same as any other tax yearApril 15. The exact due date for tax filing extensions for tax year 2021 is Oct. The bottom line here is that if you owe the IRS money, get your tax return in as soon as possible. As of early 2017, the IRS interest rate is set at a 4% annual rate, and this is subject to change over time. If you pay late, interest will accumulate on your past-due balance, in addition to these penalties.

That's why I say that it's better to file and owe the IRS money than to not file at all. Usually, when April 15 falls on a weekend the tax deadline is moved to the following Monday. On the other hand, the late payment penalty is 0.5% per month or partial month, just one-tenth of the amount it'll cost you if you don't file at all. April 18 is this years deadline to file taxes or apply for an extension. As I write this, it's just a couple of weeks past the tax deadline, so you still have time to file your 2016 return and limit your late filing penalty to just 5% of your balance. This is the deadline to submit individual tax returns for the year 2015 or to request an automatic extension, which provides an additional six months to file your return.

The failure to file penalty is 5% per month (or part of a month) after the tax deadline has passed, up to a maximum of 25% of your unpaid balance. If you owe the IRS money, here's what you need to knowĮven if you can't pay what you owe yet, it's important to file as soon as possible.

0 kommentar(er)

0 kommentar(er)